Unknown Facts About Matthew J. Previte Cpa Pc

Unknown Facts About Matthew J. Previte Cpa Pc

Blog Article

4 Easy Facts About Matthew J. Previte Cpa Pc Explained

Table of ContentsMatthew J. Previte Cpa Pc Things To Know Before You BuyLittle Known Facts About Matthew J. Previte Cpa Pc.Not known Factual Statements About Matthew J. Previte Cpa Pc Not known Details About Matthew J. Previte Cpa Pc The 9-Minute Rule for Matthew J. Previte Cpa PcIndicators on Matthew J. Previte Cpa Pc You Should Know

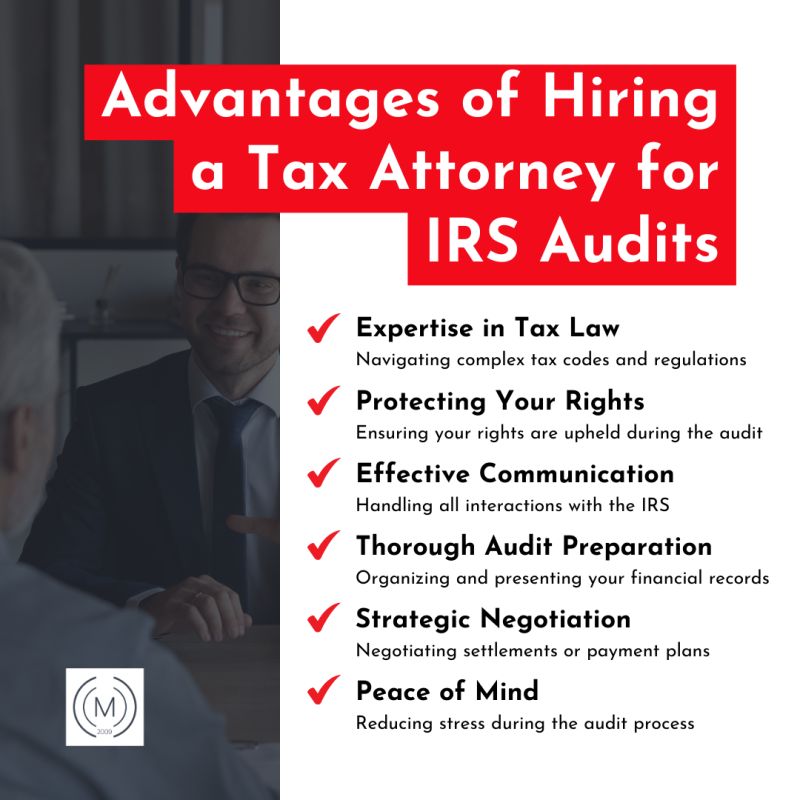

Tax obligation legislations and codes, whether at the state or federal degree, are also complicated for the majority of laypeople and they transform frequently for many tax experts to stay up to date with. Whether you just need someone to assist you with your organization revenue tax obligations or you have actually been charged with tax obligation fraudulence, work with a tax lawyer to aid you out.

The Basic Principles Of Matthew J. Previte Cpa Pc

Everybody else not only dislikes dealing with tax obligations, but they can be outright worried of the tax companies, not without reason. There are a couple of inquiries that are always on the minds of those that are taking care of tax problems, including whether to hire a tax obligation attorney or a CERTIFIED PUBLIC ACCOUNTANT, when to hire a tax obligation attorney, and We wish to assist address those concerns right here, so you recognize what to do if you locate yourself in a "taxing" scenario.

An attorney can stand for customers before the internal revenue service for audits, collections and appeals but so can a CERTIFIED PUBLIC ACCOUNTANT. The huge difference right here and one you require to remember is that a tax obligation legal representative can offer attorney-client privilege, meaning your tax lawyer is exempt from being forced to testify versus you in a law court.

The 8-Second Trick For Matthew J. Previte Cpa Pc

Otherwise, a CPA can testify versus you also while benefiting you. Tax obligation lawyers are extra aware of the different tax obligation settlement programs than the majority of Certified public accountants and know just how to pick the best program for your case and how to obtain you certified for that program. If you are having a problem with the IRS or simply inquiries and worries, you require to employ a tax attorney.

Tax obligation Court Are under investigation for tax fraudulence or tax evasion Are under criminal examination by the internal revenue service One more important time to employ a tax obligation lawyer is when you obtain an audit notice from the IRS - IRS Collection Appeals in Framingham, Massachusetts. https://lwccareers.lindsey.edu/profiles/4452769-matthew-previte. An attorney can connect with the internal revenue service on your part, be present during audits, assistance negotiate settlements, and maintain you from overpaying as an outcome of the audit

Part of a tax lawyer's task is to stay on top of it, so you are safeguarded. Your finest resource is word of mouth. Ask around for a skilled tax obligation lawyer and inspect the web for client/customer testimonials. When you interview your selection, request for additional references, specifically from customers who had the same problem as yours.

Rumored Buzz on Matthew J. Previte Cpa Pc

The tax obligation attorney you want has every one of the right credentials and testimonies. All of your concerns have actually been answered. IRS Seizures in Framingham, Massachusetts. Should you hire this tax attorney? If you can manage the fees, can agree to the kind of possible remedy provided, and believe in the tax obligation attorney's capability to assist you, after that of course.

The choice to work with an internal revenue service attorney is one that need to not be taken gently. Attorneys can be incredibly cost-prohibitive and make complex issues unnecessarily when they can be settled fairly quickly. In basic, I am a huge supporter of self-help lawful remedies, especially provided the selection of informational material that can be visit their website located online (consisting of much of what I have published on taxation).

The Basic Principles Of Matthew J. Previte Cpa Pc

Right here is a fast checklist of the issues that I believe that an Internal revenue service lawyer must be hired for. Criminal fees and criminal examinations can ruin lives and bring really major consequences.

Bad guy fees can additionally carry added civil penalties (well past what is common for civil tax obligation matters). These are simply some instances of the damage that even just a criminal charge can bring (whether or not an effective conviction is eventually acquired). My factor is that when anything potentially criminal occurs, also if you are simply a potential witness to the issue, you require a skilled internal revenue service attorney to represent your rate of interests versus the prosecuting firm.

This is one circumstances where you constantly need an Internal revenue service lawyer watching your back. There are numerous parts of an IRS attorney's job that are seemingly routine.

Matthew J. Previte Cpa Pc Fundamentals Explained

Where we make our red stripes however gets on technical tax issues, which placed our complete ability to the examination. What is a technical tax obligation issue? That is a tough concern to answer, however the finest way I would certainly explain it are matters that require the specialist judgment of an IRS attorney to deal with correctly.

Anything that has this "truth dependency" as I would certainly call it, you are going to desire to bring in an attorney to seek advice from - Unfiled Tax Returns in Framingham, Massachusetts. Also if you do not keep the solutions of that attorney, an experienced viewpoint when managing technical tax obligation matters can go a lengthy way towards recognizing issues and fixing them in an appropriate way

Report this page